Rising Interest Rates and Gold-Backed Loans: Balancing Borrowing Costs With Safe-Haven Potential

How Rising Interest Rates Affect Loans for Investing in Gold

Gold is often described as a safe haven, especially when markets grow unstable. But what happens when investors borrow to buy it at the same time that central banks raise interest rates? The connection between higher borrowing costs and the performance of gold-backed loans is not always straightforward. On one hand, rising rates increase the expense of financing, reducing potential returns. On the other, economic stress that forces rates higher can also push investors toward gold, lifting its value. Understanding how these forces interact helps explain why borrowing for gold can be both appealing and risky when monetary policy shifts.

Why Interest Rates Matter

Loans work best for investors when borrowing costs remain low. Every percentage point increase in interest rates eats into the margin that investors hope to gain from gold’s price rise. If rates are climbing, the breakeven point moves further away, requiring a larger appreciation in gold to justify the loan. This is particularly significant for short-term credit products, where interest expenses accumulate quickly. The risk is clear: if gold prices stay flat during a period of higher rates, the borrower pays more while earning little. In that scenario, the safe haven becomes less of a cushion and more of a drag on overall returns.

Impact of Rate Changes on Loan Costs

| Loan Size | Rate at 2% | Rate at 5% | Rate at 8% |

|---|---|---|---|

| $100,000 | $2,000 yearly cost | $5,000 yearly cost | $8,000 yearly cost |

| $250,000 | $5,000 yearly cost | $12,500 yearly cost | $20,000 yearly cost |

Gold’s Behavior in High-Rate Environments

Gold does not pay interest or dividends, which makes it less attractive compared to interest-bearing assets when rates rise. Investors who borrow to buy gold during these times face a double challenge: higher costs and a relative decline in gold’s appeal. Historically, however, periods of monetary tightening have sometimes coincided with inflationary or geopolitical stress. These conditions can push gold higher despite rising rates. In other words, while the cost of borrowing grows, so can the potential upside. The outcome depends on whether gold rallies strongly enough to offset the heavier loan burden.

Historical Snapshot

| Period | Interest Rate Trend | Gold Price Movement |

|---|---|---|

| Late 1970s | Sharp increases | Gold surged |

| Mid 1990s | Steady increases | Gold remained flat |

| 2016–2018 | Gradual hikes | Gold mixed, limited gains |

Short-Term vs Long-Term Borrowing

The effect of higher rates also depends on the type of loan. Short-term credit magnifies costs quickly, pressuring investors to sell gold within narrow timeframes. If gold does not move fast enough, repayment can eat away any advantage. Long-term loans, while offering breathing room, accumulate higher total costs if interest stays elevated for years. The choice of loan horizon determines whether rising rates can be tolerated or not. Shorter-term borrowing requires sharper timing, while longer loans demand greater confidence that gold will climb steadily enough to cover compounding costs.

Investor Strategies to Cope With Higher Rates

Borrowers have developed strategies to minimize the negative impact of higher rates. One approach is hedging—using derivatives to protect against downside risk in gold prices. Another is diversification: treating gold not as a standalone bet but as one leg of a wider portfolio financed by credit. Some investors choose hybrid strategies, borrowing smaller amounts while holding part of their exposure in cash purchases. Each tactic aims to balance the reality of rising loan costs with the protective role that gold plays in turbulent economies. The message is clear: when rates go up, discipline and risk management matter more than ever.

Coping Approaches

| Approach | How It Works | Potential Benefit |

|---|---|---|

| Hedging | Using options or futures to offset gold volatility | Reduces loss risk if gold stagnates |

| Diversification | Pairing gold with other financed assets | Spreads repayment burden |

| Partial Borrowing | Mix of loan-funded and cash-funded purchases | Lowers exposure to high interest costs |

Future Borrowing in a High-Rate World

The relationship between rising rates and gold-backed loans will likely grow more complex in the coming years. As financial technology evolves, access to credit is becoming faster and more automated. Fintech platforms may soon allow instant loans tied directly to digital representations of gold, making it easier for individuals to leverage small purchases. At the same time, central banks’ tightening cycles are expected to remain more frequent, meaning investors will face higher average borrowing costs for longer periods. The tension between quick, easy credit and heavier interest burdens could define how new generations use debt to invest in metals.

Digital Gold Lending

Picture a system where investors borrow instantly through apps to buy fractional gold tokens stored in secure vaults. Smart contracts could set loan terms automatically, adjusting repayment schedules if rates rise. While this offers transparency and convenience, it also creates the temptation to borrow impulsively. For disciplined investors, it could be a tool for protection during inflation shocks. For others, it risks amplifying exposure at the worst possible time.

Long-Term Tightening Cycles

Another possible outcome is a world of persistently higher interest rates, where loans remain expensive for years. In such conditions, borrowing to buy gold would only make sense during sharp economic disruptions, where gold’s safe-haven role might outweigh the loan burden. Investors would need greater patience and stronger balance sheets, while speculative borrowing would likely decline.

ESG and Lending Terms

Some lenders may begin linking loan conditions to broader sustainability goals. Investors choosing gold from verified ethical sources could see slightly better rates or higher loan-to-value ratios. This would add a new dimension to borrowing, where not just market performance but also social responsibility influences access to credit. In this way, rising rates could reshape not only costs but also the standards of lending in the metals sector.

Borrowing for Gold in a Rising-Rate Cycle

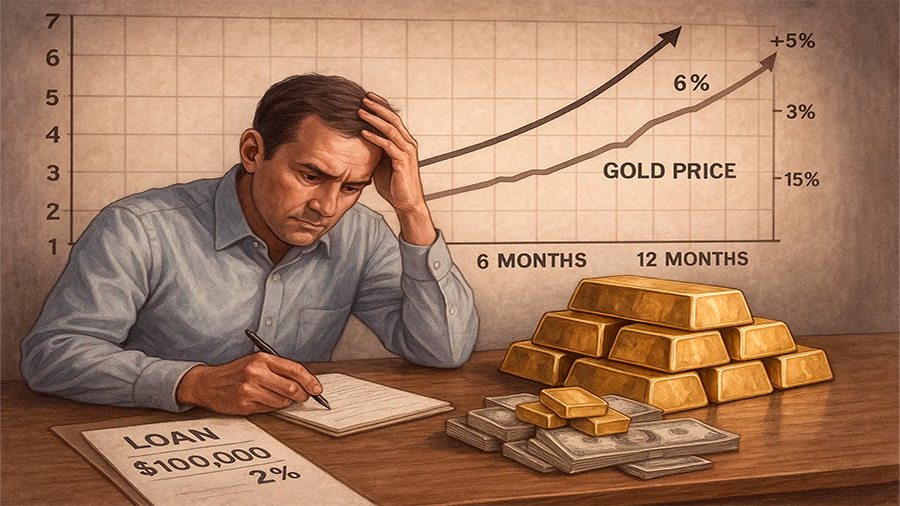

To see how these dynamics play out, imagine an investor facing a rapid increase in central bank rates. At first, the cost of credit looks manageable: a $100,000 loan at 2% creates a yearly burden of just $2,000. But within twelve months, policy changes drive the rate to 6%, and the annual expense jumps to $6,000. If gold rises strongly during this time—say by 15%—the investor still clears a net gain even after servicing debt. But if gold only moves by 3% or remains flat, the loan becomes a liability, shrinking returns or even creating losses. The reflection here is that borrowing for gold in a high-rate cycle magnifies outcomes on both sides, making discipline and timing essential.

Lesson from the Reflection

This example shows that while loans can amplify profits when gold rallies, they just as easily amplify costs when the market underperforms. In a rising-rate world, borrowers must monitor both their interest burden and the speed of gold’s movement. Flexibility—whether through refinancing, partial repayments, or diversification—becomes as important as the decision to borrow in the first place.

Conclusion

Rising interest rates reshape the logic of borrowing to invest in gold. Higher rates increase repayment costs, shifting the breakeven point further away and demanding stronger gold rallies to make loans worthwhile. Yet history shows that gold can sometimes outperform even during high-rate periods, especially when inflation or instability push investors toward safe havens. Looking forward, technology, sustainability, and global monetary trends will add new layers to this balance. For anyone using credit to access the gold market, the lesson is not to avoid borrowing entirely but to understand the added burden, prepare for volatility, and borrow only with a clear strategy in mind.

Financial Analyst & Luxury Asset Lending Specialist

Financial Analyst & Luxury Asset Lending Specialist