The Role of Structured Loans in Logistics: From Liquidity Protection to Operational Continuity

When Loans Support Logistics Instead of Killing Liquidity

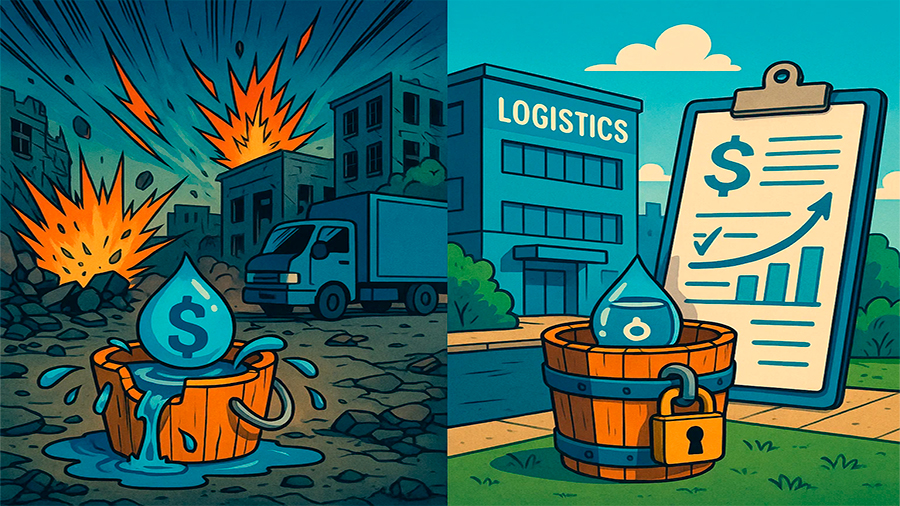

In many industries, loans are seen as a burden—cash gets tied up, interest drains revenue, and repayment becomes a drag on liquidity. But logistics is different. Here, credit often functions less like a weight and more like a lifeline. Instead of killing liquidity, borrowing can preserve it, keeping supply chains alive during disruptions and stabilizing operations when shocks hit. The difference lies in intent and structure. A loan used for risky expansion during uncertain times can ruin a company. A loan tied directly to operational continuity, however, can keep fleets on the road, ports moving, and goods flowing. This dual reality is what makes logistics borrowing a field worth examining closely.

Why Logistics Needs Smart Borrowing

Logistics is not an industry that can stop and wait. Trucks still need fuel, ships require crews, and warehouses must stay operational even when revenue dries up. This creates a constant tension between high capital needs and tight margins. When global disruptions hit—be it port blockages, strikes, pandemics, or surging fuel costs—cash flow is the first victim. Without credit, companies risk insolvency within weeks. Smart borrowing fills that void. It secures temporary liquidity so firms can keep paying workers, cover surcharges, or charter alternative routes. Rather than draining resources, loans extend breathing space, turning short-term crises into manageable challenges. This explains why logistics operators often maintain pre-approved credit lines—they know that liquidity is not a luxury but a survival mechanism.

Logistics Costs Covered by Loans

| Type of Expense | How Loans Help | Impact on Liquidity |

|---|---|---|

| Fuel price spikes | Short-term credit to absorb sudden costs | Shields working capital from volatility |

| Port congestion fees | Emergency loans cover added surcharges | Keeps cargo moving without draining reserves |

| Fleet maintenance | Structured loans for repairs and upgrades | Prevents operational halts from breakdowns |

| Temporary storage | Loans finance extra warehousing | Preserves delivery timelines |

Government and Corporate Roles

Logistics crises often spill across borders, and the scale of funding required can overwhelm private firms alone. This is where governments and corporations step into complementary roles. Governments secure international loans to rebuild ports, stabilize fuel supplies, or create alternative trade corridors. Companies, on the other hand, use loans to adapt daily operations, funding temporary warehousing or leasing third-party transport. These two layers of borrowing work together: public loans restore infrastructure at scale, while corporate loans ensure business continuity at the operational level. Without this dual response, disruptions can escalate into prolonged economic damage. It is a reminder that liquidity in logistics is not only a corporate concern but a matter of national and even global stability.

Liquidity Preservation Through Structure

The danger in borrowing is real: poorly structured loans can trap logistics companies in cycles of repayment, leaving them with less liquidity instead of more. The difference lies in how the loan is designed. Supportive loans tend to include features like longer maturities, repayment grace periods, or interest rates tied to freight volumes. These structures ensure repayment follows income rather than arriving before it. Another protective feature is the use of emergency triggers—clauses that allow funds to be drawn instantly when disruptions occur. By matching debt service schedules to the unpredictable rhythm of logistics, these loans prevent liquidity drains. When lenders design credit products that reflect real operational cycles, borrowing becomes a stabilizer instead of a risk.

Structural Features That Protect Liquidity

| Loan Feature | Application in Logistics | Benefit |

|---|---|---|

| Grace periods | Postpone repayments until cargo flows normalize | Relieves immediate cash strain |

| Volume-linked interest | Rates tied to shipping throughput | Keeps costs proportional to revenue |

| Emergency credit triggers | Automatic release of funds during disruption | Instant liquidity support |

| Longer maturities | Spread repayment over years for port or fleet loans | Stabilizes capital planning |

Case Reflections: When Loans Save Supply Chains

Consider how loans have historically saved businesses from collapse during crises. During the 2021 container shortage, many shipping companies borrowed to lease additional containers and pay for alternative routes through smaller ports. Without those loans, entire trade flows would have stalled. In another instance, food exporters used credit to cover skyrocketing air freight costs when maritime routes were blocked. These examples highlight a pattern: borrowing during disruption is not about chasing profits but about preserving operations and credibility. Clients rarely care why a delivery is delayed; they care about whether contracts are honored. Loans, when used correctly, bridge the gap between operational obligations and delayed revenue.

Risks That Cannot Be Ignored

Not all borrowing is safe. Rising interest rates can quickly turn liquidity-supporting loans into burdens if repayment costs outpace recovery. Over-borrowing, especially when disruptions last longer than expected, can push firms toward insolvency. Governments too face risks; multiple overlapping crises can push national debt levels to unsustainable heights. Transparency, accountability, and careful forecasting are essential. The balance lies in borrowing enough to preserve operations without creating future repayment crises. It is a fine line, but one that logistics actors must walk carefully.

Looking Forward: Mini-Scenarios

The relationship between loans and logistics will evolve by 2030. Borrowing will not vanish but will be reshaped by technology, policy, and sustainability demands. Future scenarios provide a glimpse of how credit might become more integrated with logistics operations.

Digital Credit Triggers

Imagine a logistics company tied into a digital system where weather alerts, port closures, or strikes automatically trigger pre-approved loans. Funds flow instantly into company accounts, allowing them to reroute cargo, lease transport, or pay fees without delays. This automation removes the lag that currently weakens liquidity during crises.

Government Resilience Loans

Governments may develop resilience loan frameworks, secured in advance with international partners. These funds would release automatically during declared logistics emergencies, financing rapid repairs or alternative corridors. By 2030, such pre-arranged credit may function like insurance, preventing disruptions from crippling national economies.

Sustainability-Linked Borrowing

As global supply chains face pressure to decarbonize, loans may increasingly be tied to environmental conditions. A company that invests in cleaner fleets or energy-efficient warehouses could receive better terms, ensuring that liquidity is not only preserved but aligned with broader sustainability goals.

Conclusion

Loans in logistics are not inherently destructive. When poorly structured, they kill liquidity and trap firms in repayment cycles. But when designed with operational continuity in mind, they are lifelines that keep supply chains alive under pressure. From covering fuel costs to financing port recovery, borrowing has already proven essential. With structural features like grace periods, triggers, and sustainability-linked incentives, loans will continue to evolve into strategic tools. Looking toward 2030, the integration of digital credit systems and government resilience frameworks suggests borrowing will become more preventive than reactive. In the world of logistics, liquidity and debt are not opposites—they are partners in survival.

Financial Analyst & Luxury Asset Lending Specialist

Financial Analyst & Luxury Asset Lending Specialist